Are you an Australian resident who wants to take advantage of the benefits offered by private health insurance? Navigating the complexities of the Australian private health insurance system can be challenging. One crucial aspect of understanding your private health insurance is knowing about your private health insurance benefit code. With the countless details and nuances that pervade private health insurance, it can be difficult to find simple explanations on finding and using information relevant to you.

In this article, we will guide you through what a private health insurance benefit code is, how to find it, and how it relates to the health insurance rebate.

What Is a Private Health Insurance Benefit Code?

A private health insurance benefit code is an identifier that outlines the private health insurance rebate you are entitled to, based on the details of your policy. Specifically, this code depends on your age, as well as the date during which the premiums were paid. Understanding your benefit code is essential in making informed decisions about your healthcare and ensuring you receive the appropriate benefits and rebates from the Australian government. Importantly, the health insurance benefit code indicates the maximum possible rebate given the payment period and the age of the oldest policy holder. Other factors such as income tiers may affect your eligibility for rebates.

How to Find Your Health Insurance Benefit Code

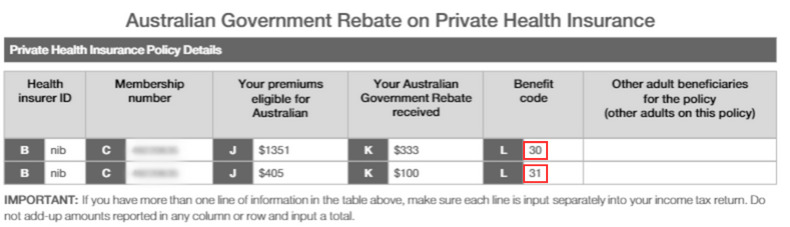

Your private health insurance benefit code can be found in the annual statement sent to you by your private health insurer. This statement provides a comprehensive overview of your coverage, premiums paid, and other important policy details. It is essential to review this statement carefully, as it is a valuable resource for understanding your benefits and tracking your health insurance policy's performance. Here’s where to find your code:

There are two rows on your health insurance statement because the benefit codes apply to different periods in the year. Therefore, depending on when the premiums were paid, a different code will apply. The following table shows the benefit codes as they relate to age and time premiums were paid:

| Age of oldest policy holder | Benefit Code: 1 July to 31 March | Benefit Code: 1 April to 30 June |

|---|---|---|

| Under 65 | 30 | 31 |

| 65-69 | 35 | 36 |

| 70+ | 40 | 41 |

It’s important to familiarize yourself with your health insurance benefit code and its implications, as this knowledge will empower you to make the most of your private health insurance policy. By understanding your benefit code, you can ensure you’re getting the appropriate rebate for your private health insurance.

Benefit Codes and Health Insurance Rebate

Your private health insurance benefit code plays a significant role in determining the private health insurance rebate percentage you'll receive. The Australian government offers a rebate on private health insurance premiums to make coverage more affordable and accessible for residents. This rebate is means-tested and depends on the age of the oldest policyholder and their annual income. The benefit code fits into this by indicating the highest rebate you are eligible for given your age; however, it does not account for income. The private health insurance rebate percentage increases with the age of the policyholder, meaning older Australians are eligible for a higher rebate. Conversely, the rebate percentage decreases as the policyholder's income rises. Understanding your benefit code can help you predict the rebate you're eligible for, allowing you to budget accordingly and maximize the value of your private health insurance policy.

Understanding your private health insurance benefit code is crucial in navigating the Australian private health insurance system. It helps you identify the applicable rebate percentage based on your age and income.

Importantly, you are eligible for the private health insurance rebate no matter which health fund you belong to, so to ensure you’re getting the best cover at the lowest price, take a few minutes to compare your health insurance premiums with Health Deal.

Comparing your options will help you find the best policy for your unique needs and budget, and make sure you aren’t overpaying for coverage you don’t need. Compare health insurance online in minutes today.

Single

Single Couple

Couple Family

Family Single Parent

Single Parent