Have you noticed your health insurance premiums creeping up year after year? It’s part of a growing trend often referred to as “health-flation”: the steady rise in healthcare costs that’s putting extra pressure on Australians, especially seniors.

As we age, our healthcare needs usually become more frequent and more complex. That makes having the right health insurance even more important, but it also means that rising costs can hit harder. For many older Australians, the cost of seniors health insurance is becoming a serious concern, with some forced to make tough decisions about what they can afford to keep covered.

That’s why staying informed matters. By comparing policies, understanding your needs, and knowing what to look for, you can avoid paying more than you have to, or worse, being underinsured when you need care the most. In this article, we’ll look at what’s driving rising health premiums, how it affects senior Australians, and what steps you can take to protect your health without breaking your budget.

Why Are Health Insurance Costs Rising for Seniors?

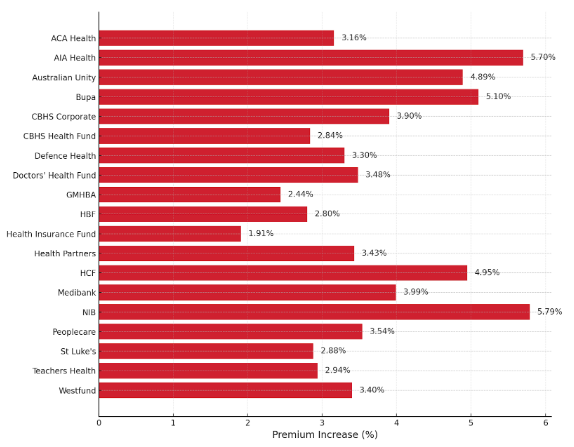

In 2025, health insurance premiums will increase by an average of 3.73%, according to the Australian Government Department of Health and Aged Care. Some policies will increase by much more, depending on the fund and level of cover. This is the biggest increase since 2018. There’s no singular reason why health insurance premiums are rising, but a few key factors are at play.

2025 Insurance Premium Increase by Health Fund

Source: Australian Department of Health

One of the biggest drivers is medical inflation. Simply put, the cost of providing healthcare is rising. New treatments, advanced medical technology, and higher demand for specialist services all add up. These improvements are great for health outcomes, but they come at a cost, and health funds pass that cost on to members through premium increases.

Australia’s ageing population is another piece of the puzzle. As more people enter retirement age, the demand for hospital care and chronic disease management grows. This means health funds are paying out more in claims, especially for common procedures among seniors like joint replacements, cataract surgery, and cardiac care.

Seniors are also more likely to make regular claims for essential treatments, which places them in a higher-usage category, leading to higher premiums in some cases. And while rebates and discounts can help, they don’t always keep pace with the underlying growth in healthcare costs across Australia.

Understanding these drivers is the first step in managing your cover. The good news? There are still ways to find value, avoid unnecessary extras, and keep your premiums as low as possible without giving up the cover you need.

Impact of Rising Health Insurance Costs on Seniors

For many older Australians, rising health insurance costs can lead to real financial pressure. Seniors living on fixed incomes often find themselves having to make difficult choices: keep paying for cover that keeps getting more expensive, or cut back and risk not being fully protected when they need it most.

This kind of financial strain can lead some people to downgrade their policies or drop private health insurance altogether. But doing so can come at a cost. Without adequate cover, accessing timely healthcare, especially in the private system, becomes much harder. That can mean longer wait times in the public system, limited choice of doctors or hospitals, and more stress when dealing with health issues that need attention.

This is particularly challenging for seniors managing chronic conditions, or for those recovering from surgery or navigating disability. Regular care, rehab, and ongoing treatment all add up, both in terms of cost and quality of life. Losing access to certain services or skipping treatments due to affordability can lead to worse outcomes down the line.

That’s why it’s so important to stay on top of your cover. Even as health premiums rise, maintaining access to the right hospital services, treatment options, and no-gap providers can make a huge difference in both your health and your peace of mind. The key is not necessarily to pay more but to know what you’re paying for and whether your policy still matches your needs.

Understanding Available Health Insurance Discounts for Seniors

If you’re feeling the pressure of rising premiums, it’s worth knowing there are health insurance discounts and rebates available that can help make premiums more manageable.

Pensioner Rebates and Government Incentives

In Australia, we have what’s called the Australian Government Private Health Insurance Rebate. This rebate helps reduce the cost of hospital, extras, or combined policies and is income-tested. That means the less you earn, the more rebate you may receive. Once you turn 65, you're entitled to a higher government rebate on your health insurance premiums. This rebate is designed to make private cover more affordable and is applied as either a discount on your monthly payments or a tax offset.

Here’s how it works:

- If you’re 65 to 69 and earn up to $97,000 as a single or $194,000 as a couple or family, your rebate increases from 24.6% to 28.7%.

- When you turn 70 or older, the rebate increases again to 32.8% for the same income levels.

This means that as you get older, the government pays a larger portion of your premium, helping you maintain your cover even if your income stays the same or drops in retirement.

How to Check If You’re Eligible

If you receive the Age Pension, your rebate eligibility is usually straightforward. If you're unsure, your health fund or a comparison service like Health Deal can help you determine what you're entitled to and how it affects your premium.

Understanding these rebates and discounts is a simple but effective way to cut down your health insurance costs without compromising on cover.

Other Ways to Maximise Savings

- Pay annually: Some funds offer an extra discount when you pay for a full year in advance.

- Claim rebates correctly at tax time: Claim rebates correctly at tax time: If you don’t get the rebate as a discount, be sure to include it in your tax return to receive the offset.

- Review your cover regularly: By aligning your policy with your current health needs, you can avoid paying for extras that don’t apply, while making the most of your rebate eligibility.

How to Evaluate Health Insurance Policies Based on Your Health Needs

As you get older, your health needs change, and so should the way you look at your health insurance. What worked in your 40s might not be enough in your 60s or 70s. That’s why it’s important to evaluate your policy based on what you actually need, not just what you’ve always had.

What Should Seniors Look For in a Policy?

When comparing policies, start by checking that hospital cover includes the services most relevant to senior health care. This often includes:

- Joint replacements (hip, knee, shoulder)

- Cataract and eye procedures

- Cardiac and vascular treatments

- Cancer care, including chemotherapy and immunotherapy

- Rehabilitation services after surgery or injury

- Chronic disease management, like diabetes or heart conditions

Make sure these are listed under your policy’s covered clinical categories. If they’re missing or partially excluded, you might be left with unexpected coverage gaps and unexpected costs.

Key Policy Features to Check

Coverage limits: Some extras policies come with yearly limits. Make sure you’re not paying for services you don’t use, and that the services you do need (like dental, optical, or physio) are covered with reasonable limits.

No-gap and known-gap arrangements: These can help reduce or eliminate out-of-pocket costs when you’re admitted to hospital. Ask if your insurer has agreements with specific hospitals or providers.

Waiting periods: If you’re switching funds or upgrading your cover, make sure you understand what waiting periods apply, especially for pre-existing conditions or high-cost services.

How to Find Health Insurance Policies Offering the Best Value

When premiums are going up, it’s natural to want to cut costs, but the goal shouldn’t just be to find the cheapest policy. What you really want is the best value: a policy that gives you the right level of cover without overpaying for things you don’t need.

That’s where Health Deal’s comparison tool comes in handy. Health Deal makes it easy to see how policies from different health funds stack up so you can compare benefits, exclusions, premium increases, and whether common treatments for seniors (like cataracts, joint replacements, or cardiac care) are actually included.

What to Look For in a High-Value Policy

Consistent premiums: Some policies offer better value simply because they haven’t had sharp increases. Health Deal helps identify funds where premium growth has remained moderate over time.

Cover that matches your health needs: Policies that include the treatments you’re most likely to need, without making you pay for unnecessary extras like pregnancy or fertility services, are often where the best value lies.

No-gap arrangements:Policies with strong no-gap or known-gap networks can help cut out-of-pocket costs for hospital stays and surgeries, offering more predictability and less financial stress.

Policy Types That Typically Deliver the Best Value

For seniors, Silver Plus policies that include cataract surgery and joint replacements (without the full cost of Gold) often are good value. Some of Health Deal’s partner funds, like Westfund, Australian Unity, and HIF, offer options that strike a strong balance between affordability and relevant benefits for older Australians.

If you're unsure where to start, Health Deal can help filter the options based on your age, location, budget, and health needs, so you can feel confident you’re choosing a policy that offers more than just a low price tag.

Tips for Reducing Out-of-Pocket Expenses for Seniors

Even with private health insurance, out-of-pocket costs can still catch you off guard, especially when it comes to hospital stays, surgeries, or follow-up treatments. For seniors living on fixed incomes, these extra expenses can quickly add up. The good news is there are a few simple strategies that can help you minimise costs and budget more effectively for your healthcare.

Use No-Gap or Known-Gap Providers

One of the most effective ways to reduce unexpected bills is by choosing a no-gap provider. These are doctors and specialists who have agreements with your health fund to charge no more than what your policy covers, meaning you won’t be left paying the difference. If your provider charges slightly more than the fund’s limit but still within a set range, you’ll only have to pay a small, predictable amount. This is called a known-gap arrangement.

Before booking any surgery or hospital treatment, ask your fund for a list of no-gap or known-gap doctors and hospitals. It’s a simple step that can save you hundreds, or even thousands, of dollars.

Plan Ahead for Elective Procedures

If you’re scheduling non-urgent care (like joint replacements, cataract surgery, or hernia repairs), take time to review your coverage and costs before booking. Ask your specialist for an itemised quote and contact your insurer to check what’s covered and what you’ll need to pay. This gives you a chance to compare options, adjust your policy if needed, or even wait out a waiting period if you're newly covered or recently upgraded.

Budgeting for Healthcare Expenses

Make space for healthcare in your budget especially for things like policy excesses or co-paymental dental, optical, or physio appointments not fully covered by extras; and medical equipment or specialist consults not included under your current plan.

Some people find it helpful to set aside a small monthly amount in a separate account specifically for health expenses, so these costs don’t catch them by surprise.Staying on top of these costs doesn’t mean you have to compromise on care. It just means making more informed decisions. A little healthcare budgeting can go a long way toward maintaining your independence and wellbeing without unnecessary financial stress.

Choosing the Best Health Insurance for Seniors

Choosing the right health insurance as a senior isn’t about getting the most cover but getting the right cover. The best senior-friendly policies are tailored to your current needs, offer solid value, and don’t include benefits you’ll never use.

1. Focus on What You Actually Need

Start by looking at whether your policy covers services that are relevant to your stage of life, like joint replacements, cataract surgery, cardiac care, or rehab after hospital stays. Just as importantly, check if it includes things you don’t need, like pregnancy or assisted reproduction, which can sneak into some higher-tier policies and push up the cost unnecessarily.

Look for policies with clear annual limits that match your usage, strong no-gap and known-gap arrangements for hospital care and transparent information on waiting periods, especially for pre-existing conditions

2. Compare Funds Regularly (At Least Once a Year)

Start by looking at whether your policy covers services that are relevant to your stage of life, like joint replacements, cataract surgery, cardiac care, or rehab after hospital stays. Just as importantly, check if it includes things you don’t need, like pregnancy or assisted reproduction, which can sneak into some higher-tier policies and push up the cost unnecessarily.

Look for policies with clear annual limits that match your usage, strong no-gap and known-gap arrangements for hospital care and transparent information on waiting periods, especially for pre-existing conditions

3. Reassess Your Extras Cover

If you're rarely claiming outside of dental, optical, or physio, ask yourself whether your extras cover is really working for you. Some seniors pay for extras like remedial massage, chiropractic, or hearing aids they don’t actually use. Trimming these extras could save you hundreds each year without sacrificing care. And if you do use extras often, consider whether you’re getting good value for what you’re paying, especially on services with low annual limits.

Wrapping Up

Rising health insurance costs can feel overwhelming, but staying informed is the best way to stay in control. By reviewing your policy regularly, understanding what you’re covered for, and making the most of available discounts and rebates, it’s possible to protect both your health and your budget. A little planning goes a long way, especially in your later years, when having the right cover really matters.

Compare Senior’s Health Insurance with Health Deal

Not sure which private health insurance policy is right for your needs? Health Deal can help simplify the process. Our free comparison tool lets you explore policies side by side so you can see what’s included, how premiums compare, and which options best suit your health needs as a senior. It’s a straightforward way to take the guesswork out of choosing cover that works for you now and into the future.

Looking for personalised advice? You can speak with a Health Deal insurance specialist who’ll walk you through your options, answer your questions, and recommend policies based on your age, budget, and healthcare needs. Call 1300 369 399 or email enquiries@healthdeal.com.au.

Disclaimer

This guide is for informational purposes only and should not be taken as medical or financial advice. Health Deal is proud to partner with a range of health insurance providers. While we strive to provide accurate and up-to-date information, health insurance policies and benefits may change. Always check with a financial professional before making any decisions. Health Deal compares selected products from a panel of trusted insurers but does not compare all products in the market. Before signing up for any policy, make sure to read the Product Disclosure Statement (PDS) and check the fund’s official website for the most up-to-date information. For the most current information, please refer to your chosen health fund’s official website or speak with one of our health insurance experts.

Single

Single Couple

Couple Family

Family Single Parent

Single Parent