What is the Private Health Insurance Rebate?

Introduction

Would you like to save money on your health insurance premiums? If so, you can receive up to 33% back on what you spent throughout the year on your health coverage through the Australian Government Private Health Insurance Rebate.

What is the Private Health Insurance Rebate?

The Australian Government provides a fixed amount towards the cost of your private health insurance premium. This rebate is the Government’s strategy to encourage more Australians to invest in their health through insurance.

Your eligibility for this rebate is dependent on your income, your age, and your family status. If you qualify, at the end of every financial year you can apply for the rebate when you are filing your tax returns or have it deducted from your regularly scheduled premium payments

Why is the rebate important?

If more Australians took up the private health insurance rebate initiative, this would alleviate some of the pressure off of the public health system. When this happens, those who use the public system will benefit from shorter waiting lists and prompt treatment, and those with health insurance will be able to save on their private health cover. This way, both the private and public health system remain sustainable and everyone can receive outstanding health care.

How to calculate the Private Health Insurance Rebate

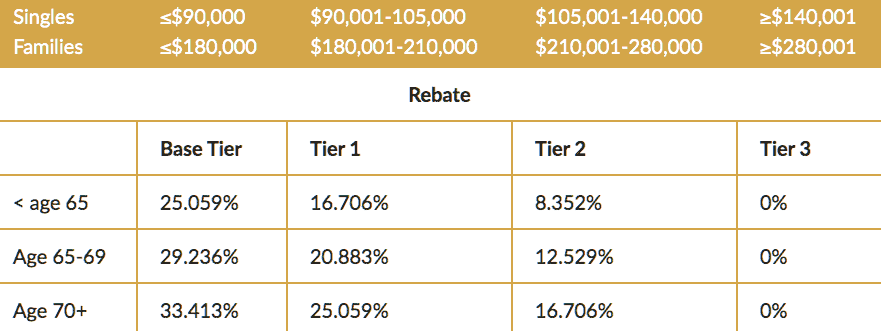

Your rebate is income tested, so basically the less you earn, the more you are entitled to. Singles earning over $140,000 and families earning over $280,001 automatically do not qualify for the Australian Government private health insurance rebate.

Singles earning $90,000 and less and families earning $180,000 and less are eligible to receive the highest rebate known as the base tier. This demographic can claim up to 33% back on the PHI rebate if the oldest member under cover is 70 years old or more.

To determine which tier you and your family fall under, refer to the table below. (Valid from 2018-2019)

Real examples of the Private Health Insurance Rebate

Example 1

Tim is 32 years old, single, earns $86,000, and holds a Silver hospital policy. His premium amounts to $140.45 per month, $1,685.40 per annum. When he lodges his tax returns at the end of October, he is entitled to claim a 25.059% rebate on his private health insurance.

Tim’s private health insurance rebate allows him to claim $422.30. He can claim this in one of two ways:

- Tim can fill out the Medicare Rebate Claim Form and contact his health fund with his estimated income and arrange to have that amount deducted from his monthly premium.

- Or he can claim that amount when is lodging his tax return with ATO

Example 2

Sandra and Robin Davis are 65 and 71 years old respectively. Their combined income amounts to $106,000 and they hold a Silver Plus combined cover which they pay $430.45 a month for, and $5165 per year. As Robin is aged 71, this entitles Sandra and Robin to claim from the Tier 2 category of the private health insurance entitling them to claim 16.706%, giving them an $862.93 rebate on their private health cover.

Tips and Reminders for the Private Health Insurance Rebate

- You must be an Australian citizen, hold a Medicare card, and be a member of a registered health insurer and earn less than $140,000 as a single and less than $280,000 as a family to be eligible for the private health insurance rebate.

- Your rebate status is based on your family status on the 30th of June.

- Single-parent families and de facto relationships are subject to family tiers.

- When deciding where you stand on the private health insurance rebate tiers, you will always use the age of the oldest person covered by your couple or family policy.

- If you nominate the wrong tier and earn less than you informed your health fund, you will receive a tax offset with your tax return. If you earn more than the tier that you chose, you will need to refund the incorrect amount with your tax return.

- The rebate percentage is regulated every 1st of April, so be sure to keep up to date with the latest rebate tiers.

ARE YOU READY FOR RATE RISE?Read here LHCLifetime Health Cover Loading Read Here MLS Medicare Levy Surcharge Explained Read More Here

Previous

Next

Gail Read More

Hello, I recently spoke with Daniel, about helping me to get a cheaper health insurance, and I am pleased to say he did just that, being on a pension and paying rent, there is not a lot left over for nicer things, so thank you.

customer Read More

Fantastic friendly service. Saved me a lot of money, gave me a better understanding of what my premiums were paying for & explained things in a clear & concise manner

Jennifer Read More

Fantastic friendly service. Saved me a lot of money, gave me a better understanding of what my premiums were paying for & explained things in a clear & concise manner

Previous

Next

Single

Single Couple

Couple Family

Family Single Parent

Single Parent