How to submit your health insurance claims and how they get processed

Introduction

If you’re new to private health insurance or have never submitted a health insurance claim, the process can seem confusing.

Not to worry, insurers have given you several quick and easy ways to claim on your extras health insurance and private patient admission is a simple process that gets sorted out quickly at the administration desk.

In this post, Health Deal gives you a full rundown on claiming your private health insurance extras, what happens during hospital admission, and how to calculate the Australian government private health insurance rebate.

What is claiming extras?

The whole point of having a private health insurance extras policy is to save on medical services that you use often. Extras services are not generally covered by Medicare, like visiting the dentist for a clean and scale, getting your sore back sorted at the chiropractor, or getting a new pair of prescription glasses.

When you visit the dentist, for example, after your treatment when you go to square up your dental fees, you will swipe your membership card, get a certain amount knocked off the bill, and you only pay the difference between the benefit amount paid for by your insurer and the fee quoted by your dentist.

Interested in finding the perfect extras policy? Click here for more details

How can I submit a private health insurance claim?

HOSPITAL COVER

At the hospital

When you’ve been admitted, you will need to show the hospital admin staff your private health insurance membership card and pay any applicable excess so that they can check your cover and submit your claim.

How does this work?

If your doctor agrees to participate in your health fund’s gap scheme, a bill will automatically be sent to your health insurer and Medicare. Otherwise, you will need to pay the difference between the doctor’s fee and your insurance benefit.

EXTRAS COVER

There are several quick and easy ways to claim through your health insurance extras policy. Most health funds have similar claiming methods, which are:

1) On the spot

If your healthcare provider has a HICAPS machine you can submit your claim by simply swiping your membership card when it’s time to make your payment.

How does this work?

Your rebate amount or percentage will be automatically knocked off the provider’s fee, and you only pay the difference between that sum and what your health insurance pays for that service.

2) Via an app

Many health funds now allow you to submit your health insurance claim through a customized app. You will need to download the app from the App Store or Google Play, log in, select register and enter the relevant member details. All health insurance apps differ, but some require you to enter your healthcare provider’s number, item code and fee, and you may also need to take a clear snapshot of your official provider receipt with all the following information visible:

- Name and contact of your provider

- Full name and address of the member/patient

- Date you received medical treatment

- Description of the medical service

- The fee charged

How does this work?

Once you’ve entered all the proper details, press submit and your health fund will do the rest. Usually, if your fund has your direct debit details on file, they will pay straight into your bank account within 5 business days.

3) Online

Once you’ve set up your online access with your insurer’s website, simply login and provide the relevant details such as your healthcare provider’s number, medical service item code, and fee. And similar to the app, you may be required to upload a photo of your receipt with all the details clearly visible.

How does this work?

Once you’ve entered all the proper details, press submit and your health fund will process your claim. Usually, if your fund has your direct debit details on file, they will pay straight into your bank account within 5 business days.

4) Email

Some private health insurers allow you to submit your claim through email. Simply download the form, fill, and attach your receipts.

How does this work?

Your rebate will be deposited into your bank account, usually within a week.

5) By Mail

You can usually submit your claim through the post. Simply print out or pick up a claim form, complete it, and provide an itemised account of your treatment along with your original receipts and mail them to your health fund.

How does this work?

Your rebate will be deposited into your nominated bank account, usually within a few weeks.

6) In person

You will need to print out and fill a claim form from your health fund’s website and attach your receipts and an itemised account for the treatment you are claiming. Visit your health fund’s nearest branch with these items and your membership card to submit your claim.

How does this work?

Your rebate will be deposited into your nominated bank account, usually within 5 business days.

How to submit your claim for the private health insurance rebate

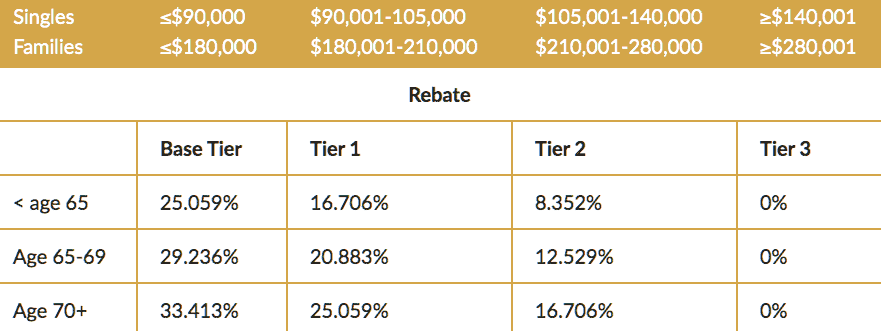

If you or your family have private health insurance you may be eligible for the Australian Government Rebate. This government initiative was put into place to encourage Australians to take out private health cover and make private health insurance affordable. The rebate percentage you are eligible for depends on your income.

Each year you can submit your claim for the private health insurance rebate from the federal government in the following ways:

Claim your rebate on your income tax return: At the end of each financial year health funds provide you with a statement that you can use to apply for with your tax returns

Have your rebate deducted from your monthly health insurance premium: To claim your private health insurance rebate in this way you will need to get in touch with your health fund to make the necessary arrangements.

In order to calculate your rebate, refer to the table below which remains valid from the 1st April 2019 to the 31st of March 2020:

How to get the most out of your health cover

Private health insurance is one of those bills we’d like to forget about but it is an important commodity to have. There are several benefits to having medical insurance, not least of these the capacity to choose your own doctor as well as not having to sit out your illness on the long public waiting list.

There are several ways to get the best out of your health cover, such as:

- Choose a policy that is relevant to your stage in life

- Have a yearly comparison to see that you have the best hospital and extras cover

- Ask for a restriction on some of your benefits if you aren’t likely to use them soon

- Consider having separate single policies instead of a couples policy if it is cheaper

- Keep an eye out for premium discounts such as 4% direct debit discounts

- Have a tailored health policy to make certain you’re not over or under-covered.

At the end of the day, you want to be sure that you are adequately covered in a medical emergency as well as making sure that you’re getting the most out of your health cover. Health Deal is a free health insurance comparison service that can help you do all of the things above. We can help you find a policy that not only suits your needs, but your budget as well. All you need to do is call 1300 369 399 or compare your cover now using the table below in just a few clicks.

Single

Single Couple

Couple Family

Family Single Parent

Single Parent